TPS Software

Built for Accounting Firms. Perfected By Accountants

For 25 years, more than 10,000 accountants have trusted TPS Software to simplify and optimize their practice.

Streamlined Operations

Enhance your firm's efficiency with a solution evolved from 25 years of accountant feedback.

Boosted Productivity

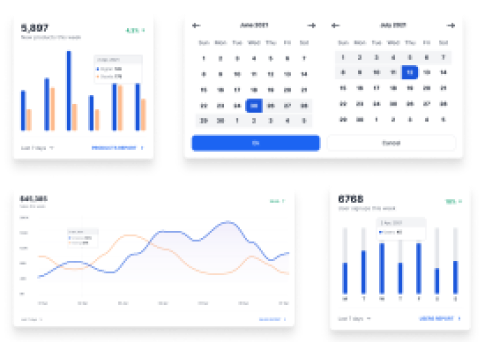

Leverage a tool that amplifies productivity through data-driven insights and practices.

Informed Decisions

Make smarter decisions with a system refined by real-world accounting needs and experiences.

Transforming Accounting Headaches into Growth Opportunities

TPS Software Transforms Everyday Accounting Challenges into Catalysts for Growth and Success.

Whether you’re a seasoned accounting professional or are working your way up the ranks, most accountants deal with the same headaches. Juggling multiple projects. Keeping track of time. Inefficient workflows. Racing vital deadlines.

Not to mention, dealing with colleagues and clients that seem to either be all up in your business or go inexplicably “MIA.”

After 25 years of serving accountants, we’ve heard it all. And we’ve designed TPS Software with both common gripes and ambitious goals in mind. From simplifying the day-to-day with intuitive tools to driving big-picture planning with in-depth analytics, TPS Software exists to make life and business easier for accountants.

We not only know what accountants need, we know what you don’t know you need… yet.

We have been customers for 15 years, and there is a reason for it.

Stephen M.

Capterra

Everything You Need to Optimize Your Accounting Practice

Simplify Your Day-to-Day and Maximize Your Long-Term Strategy With TPS Software

Track Time and Billing

Effortlessly track time with precision

Keep track of billable hours and expenses

Quickly add project details and context

Generate accurate reports for your clients

TPS Software does everything we need it to, and more. All for less than most of the competition. Very pleased.

Russell C.

Capterra

Powerful Integrations

Connect seamlessly with the tools you already use for a unified and efficient workflow.

Learn More

I want to Thank the entire TPS team for a wonderful experience over the years. Your software and support has been FANTASTIC.

If everything in the world worked as reliably and professionally as TPS software has – what a wonderful world it would be.

John M. Hoffman

Capterra

Unrivaled Customer Support

Connect seamlessly with the tools you already use for a unified and efficient workflow.

Talk to a human, not a robot.

Receive quick and effective assistance from people who “get” accountants.

Master tools quickly with built-in video guidance and a rich library of resources.

Blog Posts & Resources

Dive Into Our Blog & Resources for Real Talk on Accounting

See All Articles

Experience the Full Power of TPS Software – Your First 10 Days On Us

Test Drive TPS Software with a Free 10-Day Trial - Explore, Learn, and Transform Your Practice Management

Dive into the depths of what TPS Software can do for your accounting firm and get your first 30 days on us. Explore every feature, experience every innovation, and see for yourself how our 25 years of evolution can transform your practice management.